Flexible purchase orders

Streamline your purchasing process by receipting in goods and entering additional costs later.

RECEIPT AND COMPLETE

Purchase in your goods and receipt them into your stock on hand immediately, while the purchase order remains open so freight invoices – usually the last to arrive – can be added later.

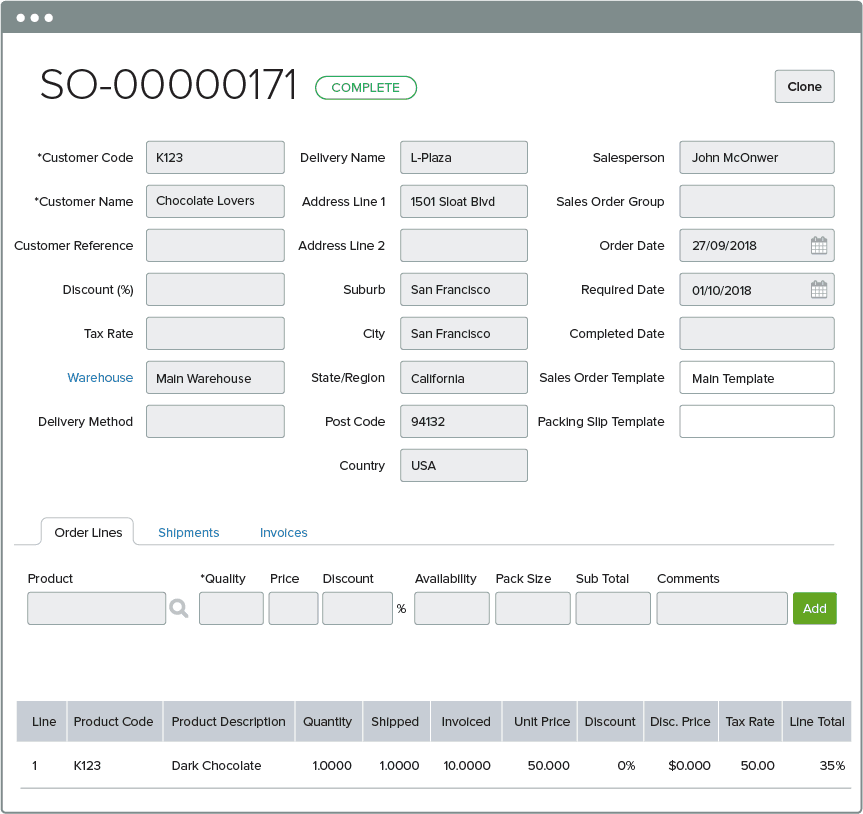

SELL YOUR GOODS

Products that have been receipted into your stock can be sold to your customers straight away, even though final costs haven’t been added to the original purchase order. No more delays.

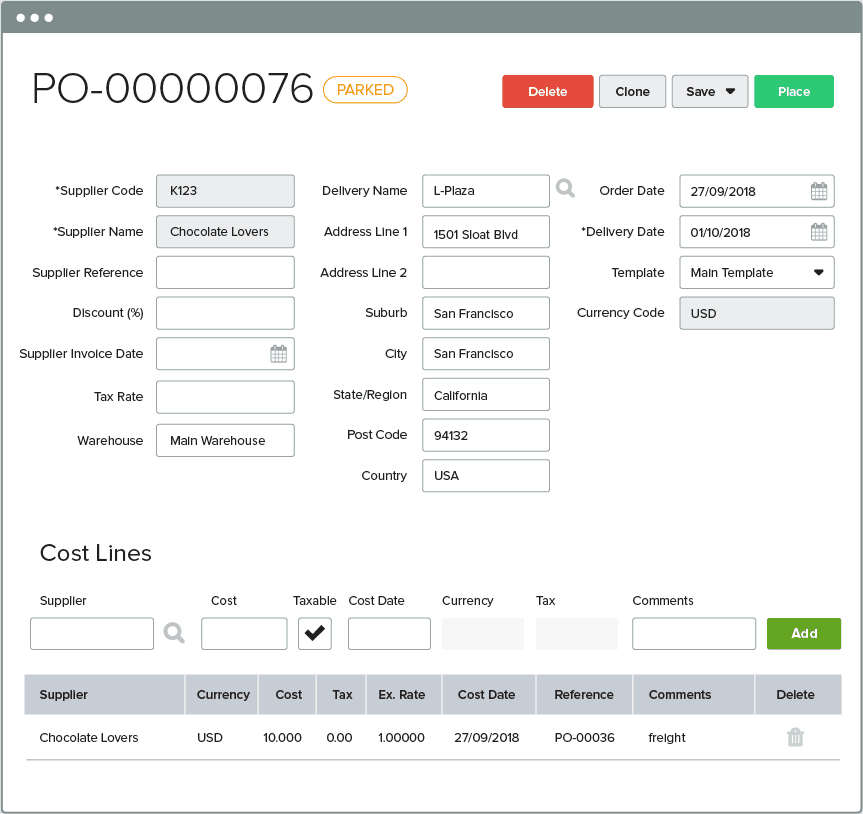

Add Purchase Costs

No more waiting for that final transport invoice to come through before you receipt a purchase order and book in your goods.

FLEXIBILITY TO ADJUST YOUR COSTS

Add purchasing costs to your order prior to receiving your goods, once you receive them, or after you’ve receipted them in.

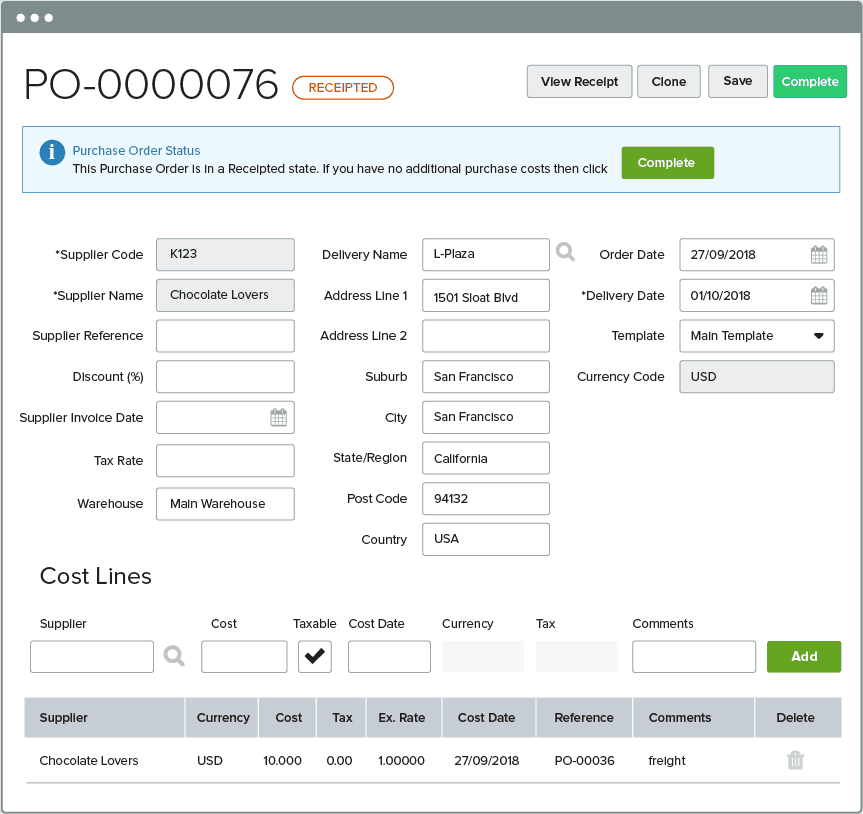

RECEIPTED GOODS

Once you receive your goods, receipt them into your stock on hand so they are ready for sale, and your margins will be accurately adjusted later, once you’ve added all the costs and completed the order.

No roadblocks

Carry on trading and update all costs when they are known.

AUTOMATIC MARGIN CALCULATIONS

Apply accurate costs to your purchases so margins will be adjusted to reflect the true costs of doing business even after the goods have been receipted in and sold.

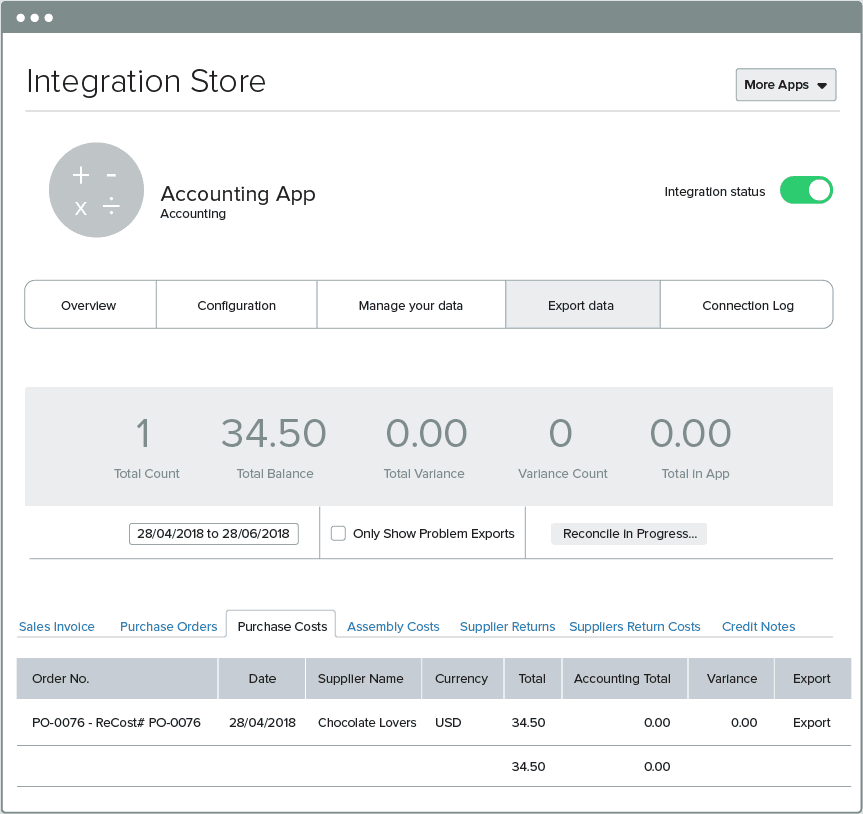

Update accounting software

Purchase Order Recosting FAQ

Contact Us today if you have more questions about how Purchase Order Recosting can work for your business.

The new “Receipted” status indicates that the items for this Purchase Order have been received into stock and that there may still be additional Purchase Order Costs that need to be added.

When component products are in a Receipted Purchase Order then Assemblies for these products will be restricted until the Purchase Order is Completed. This is because the Average Landed Cost of an Assembled product is calculated based off the Average Landed Cost of the components which cannot be definitively calculated until the Purchase Order has been completed.

Auto-Disassembled products are not supported by our Purchase Order Re-costing improvement, as such If you have an Auto-Disassembled product, you cannot receipt the purchase order. You can choose to receipt the other products on the purchase order by creating a split receipt.

The Purchase Order ReCost Bill sent to your accounting software is a payable indicating the additional costs added to a Purchase Order in a receipted stage. These are sent to your accounting software once the Purchase Order has been set to a “Completed” status.

With the introduction of our new Purchase Order ReCost Feature changes needed to be made to the columns in the Purchase Order Line Grid in order to optimise space and bring Purchase orders in line with other transaction formats. You can still view comments noted against products by selecting the comments bubble just as you would in a Sales Order.